⏰ Set a reminder to join me LIVE @ 11am EST today as I review my

⏰ top trading ideas for the week in the Market Master’s trading room

I had an awesome time trading last week, with all five of my small-stock “tactical trade” ideas landing on target.

Within a few hours, they saw gains of 70%… 30%… 40%…

One of them even saw a whopping 200% move in the pre-market two days after I wrote about it.

I’m betting on another green week for the markets as investors continue processing JPow’s half-point relief.

As promised, I’m looking to extend my win streak today with another “tactical trade” idea:

Go ahead and pull up Citius Pharmaceuticals Inc (CTXR) right now.

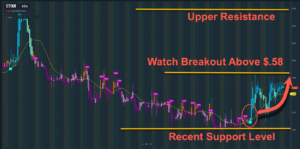

You’ll see that after a drawdown last month that extended to the first few weeks of this one, the stock had a strong bounce to close the week up 14%:

I strongly suspect this is only the beginning of a larger rally, and I think that will be confirmed if we see the stock break $.58 this morning, which has been a resistance level from last week…

If it breaks above upper resistance near $.70, we could be looking at something really huge.

On the downside, I think a break back below the $.50 support level from last week is a key area to watch.

This could be a very big day for CTXR – Make sure it is on the top of your watchlist!

CTXR itself is a late-stage biopharmaceutical company with a diversified pipeline and several near-term catalysts.

The New Jersey-based company is set to completely transform the standard of care in patients with infections stemming from Central Venous Catheters (CVCs).

If its lead candidate, Mino-Lok, is approved — and that’s looking increasingly likely — it would be the first and only FDA-approved antibiotic lock solution for salvaging CVCs.

That may not sound like the most exciting thing, but it would actually be a really huge deal.

For those who don’t know, CVCs are thin tubes that are inserted into large veins in the chest, neck, or groin.

They’re used to provide patients with medications, fluids, and nutrition and for regular blood sampling.

Every year, 7 million CVCs are used in the U.S., and 4 million of those are long-term, meaning they get used longer than a month.

Each year, approximately 500,000 of these catheters become infected, resulting in conditions known as central line-associated bloodstream infection (CLABSI) and catheter-related bloodstream infection (CRBSI).

The standard “cure” for CLABSI/CRBSI is for the patient to take a round of antibiotics and have the CVC removed and replaced.

The problem is it is extremely painful and traumatizing to remove/replace a CVC, and it can interrupt care for the patient’s underlying condition…

(Many of these patients are extremely vulnerable — undergoing chemotherapy, ICU patients, etc.)

One study found that 57%–67% of patients had adverse physical and psychological symptoms from CVC removal and replacement, with 32% experiencing moderate-to-severe symptoms.

It’s also very expensive, costing approximately $10,000 and the overall CLABSI/CRBSI treatment can cost as much as $65,000.

CTXR is hoping to replace this lackluster standard of care with Mino-Lok, an antibiotic solution intended to actually salvage infected catheters.

Mino-Lok has gone through a complete Phase 3 trial and the company reported topline results on May 21, noting that it had achieved the primary endpoint and several secondary endpoints with very high statistical significance.

Citius CEO Leonard Mazur said the CTXR is “extremely pleased by the strong results,” and that the company is preparing the full data analysis, then will meet with the FDA to discuss the path to NDA submission and commercialization.

The company estimates the potential market for Mino-Lok at more than $1 billion in the U.S. and $2 billion globally.

CTXR recently completed a spinoff of another lead asset, LYMPHIR, into a wholly owned subsidiary named Citius Oncology, and that subsidiary merged with a SPAC on August 12.

CTXR holds approximately 90% of the combined company, which operates as Citius Oncology, Inc. (CTOR).

A few days prior to the merger, LYMPHIR was approved by the FDA for the treatment of adults with relapsed or refractory cutaneous T-cell lymphoma (CTCL).

CTCL is a rare form of non-Hodgkin lymphoma that afflicts roughly 3,000 new people each year, and the overall market for it is estimated at $300–$400 million.

I don’t need to tell you what a huge deal FDA approval is, and CTXR CEO Leonard Mazir said the plan is to launch LYMPHIR before January 2025.

CTXR’s third major “shot on goal” is Halo-Lido, “a proprietary topical formulation … that is intended to provide anti-inflammatory and anesthetic relief to individuals suffering from hemorrhoids.”

Halo-Lido had a very positive Phase 2b trial, and Citius is now planning on an end of phase II meeting with the FDA to discuss the next steps in the regulatory and clinical development program.

If all goes well, Halo-Lido would be the first FDA-approved prescription product to treat hemorrhoids, a market Citius estimates at over $2 billion in the U.S. alone.

In February, Simply Wall St. wrote that “Citius Pharmaceuticals is bordering on breakeven, according to the 3 American Pharmaceuticals analysts. They anticipate the company to incur a final loss in 2024, before generating positive profits of $1.2m in 2025.” [emphasis added]

That was before many of the incredible successes I just mentioned.

Citius insiders show strong faith in the company too, with co-founder and CEO Leonard Mazur investing $22.5 million of his own money directly into the company, and with co-founder and Executive Vice Chairman Myron Holubiak investing $4 million.

I love companies where management has that type of “skin in the game.”

Analysts are bullish too:

- H.C. Wainwright reiterated a $4.00 BUY rating in late May

- EF Hutton issued a $6.00 BUY rating on July 15

- Maxim Group reiterated a $4.00 BUY rating on August 15

Those price targets represent potential upsides between 600% and 950% based on Friday’s closing price.

Spend time right now doing your own research on the stock, and of course, always approach your trading in a responsible manner. Trading is very risky, and nothing is ever guaranteed, so never trade with more than you can afford to lose. Please read the full disclaimer at the bottom of this email as well so you are aware of additional risks and considerations. Always have a well-thought-out game plan that takes your personal risk tolerance into consideration.

Bottom line: CTXR has a strong pipeline that included its recent, first-ever FDA approval. MINO-Lok and Halo-Lido could also transform the standards of care for their indications.

We saw the stock have a strong initial rebound last week, and I strongly suspect it will continue if we see a break above $.58 today.

Pay close attention to CTXR today, and let’s see if my red-hot win streak continues…

To Your Success,

Jeff Bishop

P.S. Make sure you join me and over 1000 traders in the Market Master’s trading room today for live trading signals and education. You can access it at no cost right now.

*Just so you know, what you’re reading is curated content for which we have received a monetary fee (detailed below) to create and distribute. Let’s be clear that investing can be quite the roller coaster as stock prices can have wild swings up and down, so consider those crucial risks before you ever consider trading anything we discuss. Make sure you check out our full disclosure down below for the details on how we were paid, the risks, and why these results aren’t what you’d call “typical.”

Just a quick heads up about this ad you’re reading—as we’ve said, even though we like the company referenced above, and all the facts we discussed above are true to the best of our knowledge, we are running a business here. To distribute this information and help offset the costs of maintaining our large digital audience, in advance of writing the content above, we received twenty five thousand dollars (cash) from Sica Media for advertising Citius Pharmaceuticals for a one day marketing program starting on September 23, 2024. Previously, we received twenty five thousand dollars (cash) from Sica Media for advertising Citius Pharmaceuticals for a one day marketing program starting on July 11, 2024 and also fifteen thousand dollars via ach bank transfer by Lifewater Media for advertising Citius Pharmaceuticals for a one marketing program on March 9th, 2023. These amounts were paid by someone else not connected to Citius Pharmaceuticals. It might be obvious, but whoever paid for this might own shares and is likely looking to sell some or all of them at any time after we send out this information, which might affect the stock price. We may also buy or sell shares in the company at some point in the future, although neither RagingBull nor its owners own any shares of the company at this time. Also, keep in mind that due to the sheer size of our audience, if even a small percentage of people decide they want to buy this stock, it could potentially boost interest enough to hike up those share prices and cause a temporary spike, and the opposite is possible as our program ends, though that is not always the case.

Now, diving right into Citius Pharmaceuticals might sound exciting. But remember, it’s like venturing into the wilderness—be aware that there’s exceptional risk involved in trading. This isn’t small potatoes we’re talking about; you could lose every dime you put in, so always carefully think about what you’re doing. That’s why they call this trading, after all. We’re shining a light on the good stuff about the company here, but it’s on you to do your homework, make your own calls, and determine a plan for your own trading, hopefully with the help of your professional 1nvestment advis0r.

Oh, that brings us to another crucial point—we’re not here to tell you (or even recommend) what you should do with your hard-earned money. We’re simply sharing our non-expert thoughts by highlighting some companies we like that could use some help telling their story to more people. We’re obviously biased in our writing. We’re not here to dig into anything that may be negative about the company; this is advertising, after all! Also, keep in mind that if we make some predictions about the future, these are technically known as “forward-L00king statements” under the securities acts, so take those with a grain of salt. As with all forecasts, they’re not set in stone, often wrong, and we certainly can’t know where the Company’s earnings, business, or share price will be tomorrow or a year from now.

Everything you read from us is all for your education, information, and possible entertainment. While we believe the info is reliable and accurate, we can’t wear a cape and guarantee it. Before you jump into anything, make sure to talk it over with a pro—someone you trust who’s licensed to give you real advice. To be clear,

Neither Raging Bull nor its owners, employees, or independent contractors are registered as a secur1ties br0ker-dealer, br0ker, 1nvestment advis0r (IA), or IA rep’s with the SEC, any state securities regulat0ry authority, or any self-regulat0ry organization.

So, that’s the scoop! If you’re intrigued and want to learn more about the companies we talk about, hit up the SEC’s website to dig into their filings and see the full picture.